us japan tax treaty social security

A tax treaty is covered by the MLI if both Canada and its treaty partner have listed the treaty for purposes of the MLI and have brought the MLI into force. Generally a Form W-8BEN or Form W-8BEN-E is required from individuals and entities respectively outside of the US who are the beneficial owner of.

It S Time To Rethink The Japan U S Alliance The Japan Times

By providing credit to the extent of tax already paid in the US The tax paid by Mr X in the US will be eligible for deduction in India.

. Interest ccc Dividends Pensions and Annuities Income Code Number 1 6 7 15 Name Code Paid by US. Tax from your benefits. Simultaneously the fixed rate of 082 previously 09 for long-term care insurance is also applied starting March 2022.

How to claim USUK. The United States has tax treaties with a number of foreign countries. SOLE PROPRIETORSHIP -- Ownership of all of the assets of an unincorporated business by a single individual.

Search the most recent archived version of stategov. Toyota invests in EV battery production in Japan US Toyota is investing 730 billion yen 56 billion in Japan and the US. If your railroad retirement benefits are exempt from tax because you are a resident of one of the treaty countries listed you can claim an exemption from withholding by.

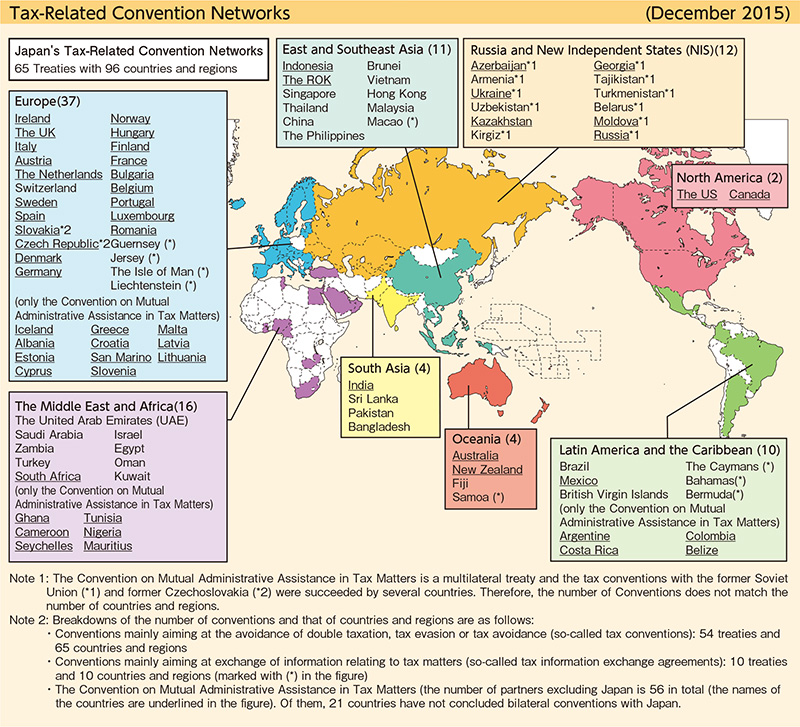

Most of those countries are expected to become parties to the MLI and to list their tax treaty with Canada. SOCIAL SECURITY CONTRIBUTIONS -- Charges levied on employees employers or self-employed or on all persons subject to individual income tax to cover the cost of providing future social security payments. Canada listed its tax treaties with 84 countries for the purposes of the MLI.

Office for International Relations Planning Div. The DTAA applies to the following taxes. To boost production of batteries for electric vehicles August 31.

If your most recent Social Security tax was paid to the. The Kyoto Protocol was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change UNFCCC that commits state parties to reduce greenhouse gas emissions based on the scientific consensus that part one global warming is occurring and part two that human-made CO 2 emissions are driving it. Premiums on child allowance is imposed separately at 036.

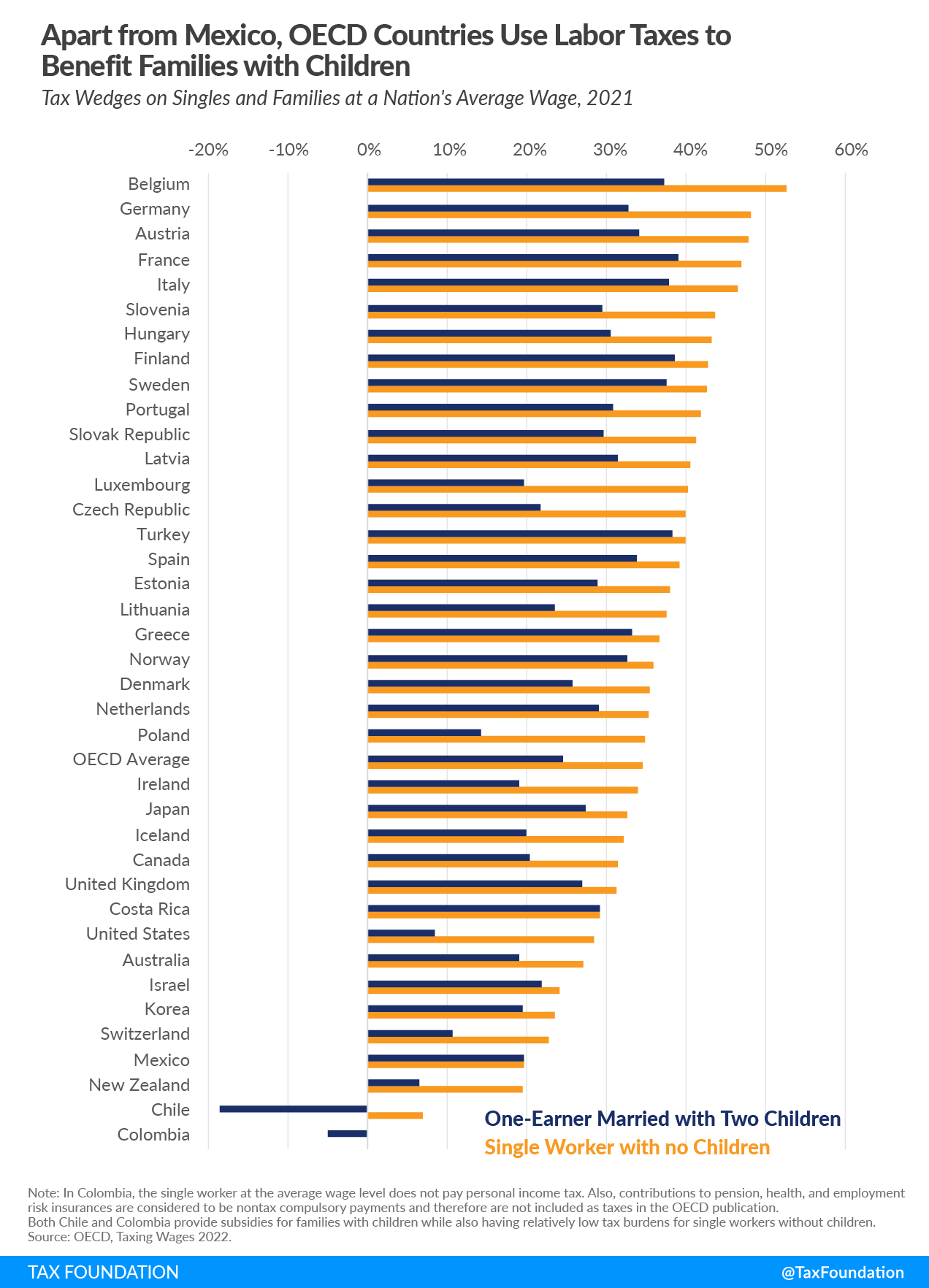

Applicability of the agreement. The levels of social security contributions are particularly high 163 of revenue against 94 on average for OECD. 1-2-2 Kasumigaseki Chiyoda-ku Tokyo 100-8945.

To help you find what you are looking for. Foreign workers in Spain must pay taxes into the Spanish social security program unless they obtain a coverage certificate from their native country showing that they are continuing to make contributions to that system. Still cant find what youre.

If the income is from a country with which the United States has an income tax treaty this withholding tax can be reduced or eliminated by submitting the appropriate withholding certificates to the payor of the income. The overall rate of social security and tax on the average wage in 2005 was 713 of gross salary the highest of the OECD. Another perk of the tax treaty is that it allows your social security UK.

For Spanish residents their contributions can be deducted on their taxes. Otherwise the beneficiary can compute a foreign tax credit on Form 1116 of Form 1040. If your social security benefits are exempt from tax because you are a resident of one of the treaty countries listed the SSA wont withhold US.

Department of State Archive Websites page. A Form W-9 will be required from US persons companies partnerships and so on. Federation of National Public Service Personnel Mutual.

Detailed description of other taxes impacting individuals in Japan Note. Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from US taxes on certain items of income they receive from sources within the United States. This table should not be relied on to determine whether a US.

This page may have been moved deleted or is otherwise unavailable. The social security budgets are larger than the budget of the national government. The DTAA applies to the residents of the contracting states ie.

Check the URL web address for misspellings or errors. National Public Service Mutual Aid. Return to the home page.

State pension to only be taxable in the country they are residing in. If you have any doubts consult your tax advisor. The appropriate tax form is automatically generated based on the answers you provide.

The individual owner is personally. India and USA subject to certain exceptions. The fixed rate of 905 previously 492 for health insurance is applied from March 2022.

Tax treaty benefits There are some situations you might run into wheredespite all the exclusions and other treaty benefitsyou may be double-taxed on income. Use our site search. Japan to ease tourism restrictions and raise daily arrival cap to 50000 Japan clarifies new border rules as it moves to allow most individual tourists to enter.

Tax resident is entitled to the listed rate of tax from a foreign treaty country although generally the treaty rates of tax are the same. Obligors General Treaty.

Should The United States Terminate Its Tax Treaty With Russia

Japan U S Relations Issues For Congress Everycrsreport Com

Japan U S Relations Issues For Congress Everycrsreport Com

France Tax Income Taxes In France Tax Foundation

Social Security Totalization Agreements

Sofa Drivers In Japan Prepare To Pay Annual Road Tax Article The United States Army

Us Japan Hail Stronger Ties Including 2 New Defense Deals Ap News

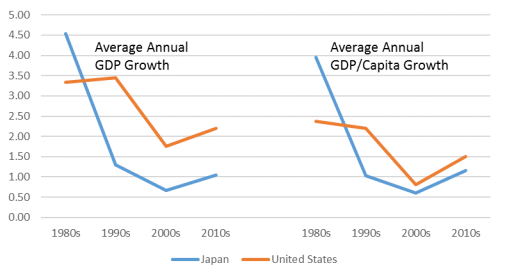

1 Means Of Driving The Growth Of The Japanese Economy Chapter 3

Here S How Japan Can Restore Trust In The Future Among Youth World Economic Forum

France Tax Income Taxes In France Tax Foundation

Japan U S Relations Issues For Congress Everycrsreport Com

Us Expat Taxes For Americans Living In Japan Bright Tax

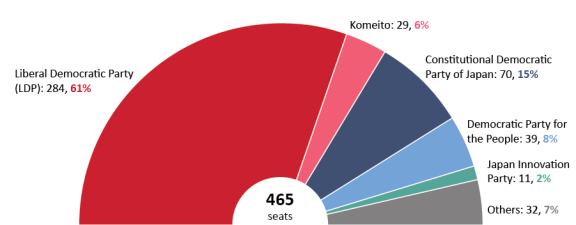

Japan Tax Income Taxes In Japan Tax Foundation

Should The United States Terminate Its Tax Treaty With Russia

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation